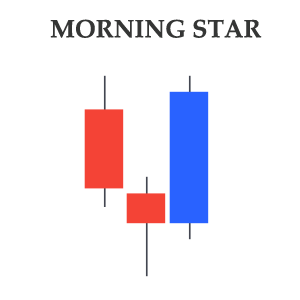

Morning Star Pattern

Morning star pattern is a well-known and widely anticipated bullish reversal pattern that is made up of three candlesticks. In this pattern, the first candlestick is bearish and has a long body. The second candlestick in this pattern opens lower than the closing of the first candlestick.

The color of the second candlestick is not important. The third candlestick in this pattern is finally bullish and its big real body penetrates deep into the real bodies of the first two candlesticks. The pattern gets its name from the second candlestick the looks like a star in between the two candlesticks.

To understand how effective the Morning Star pattern is let’s take a look at the below chart of Citigroup (C). You can see that the stock had been in a strong downtrend until at the bottom a Morning Star pattern appeared. The first candlestick in the pattern is a bearish candlestick that shows the sellers are still in control. The second candlestick opens lower than the previous closing.

Finally, the third candlestick is bullish and has a big real body that penetrates deep into the body of the first candlestick. The third candlestick confirmed the the pattern and following the signal the stock price started to gradually recover towards $70.