Dark cloud Cover

Dark Cloud Cover is another bearish reversal pattern that consists of two candlesticks. Like any other bearish reversal pattern, the Dark Cloud Cover indicates a possible change in the rising price. The first candlestick in this pattern is bullish and has a large real body. The second candlestick in the pattern is bearish and it opens above the closing of the first candlestick. The second candlestick holds real significance in this pattern. It indicates that despite opening higher than the closing of the first candlestick bulls could not hold their ground and lost control.

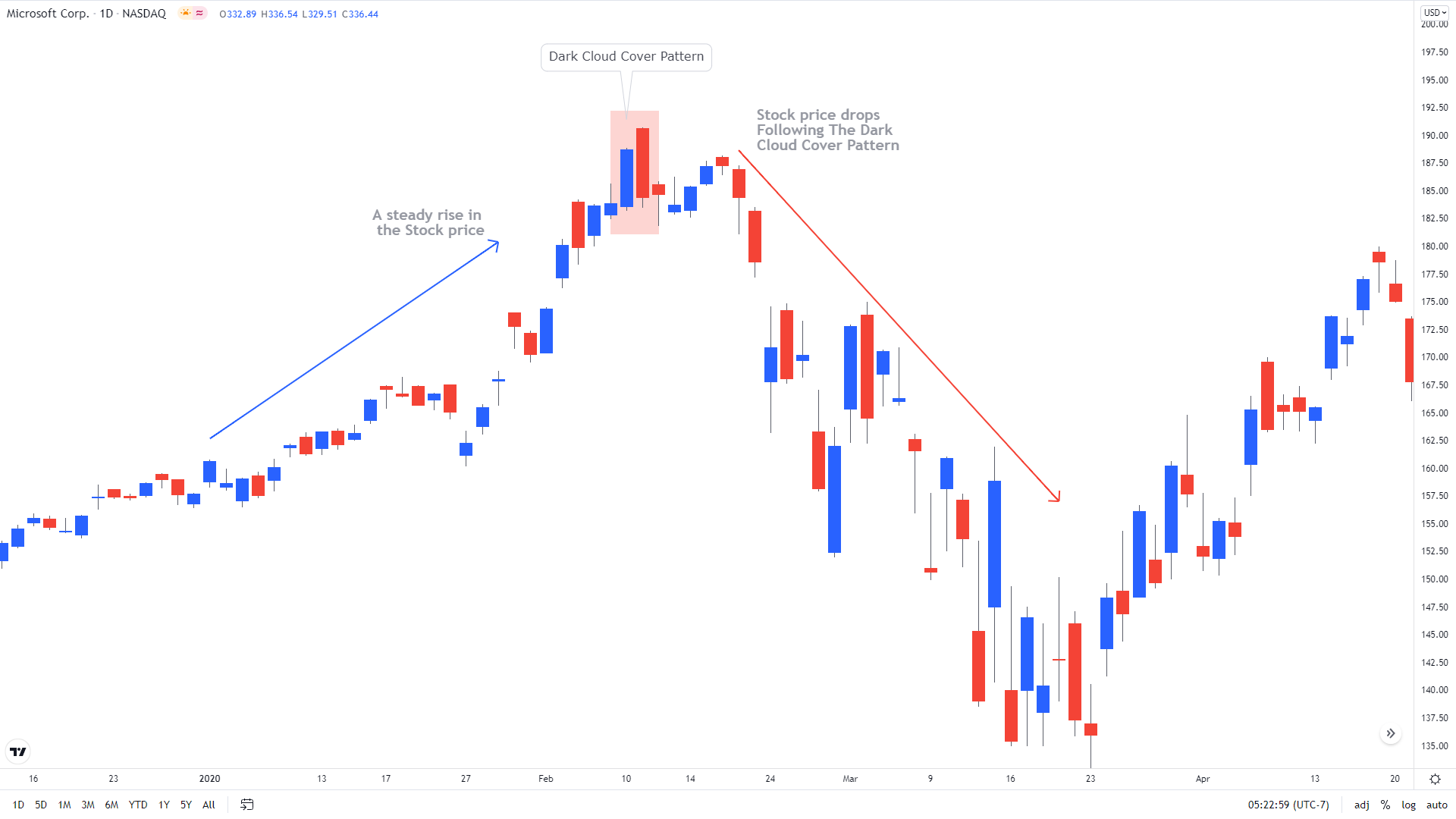

A look at the Microsoft (MSFT) chart below will indeed enlighten you on the effectiveness of the this pattern. The Microsoft stock was gaining until a Dark Cloud Cover pattern emerged around $192. The first candlestick in the pattern is bullish while the second candlestick is bearish and it opened higher than the closing of the previous bullish candlestick. The closing of the second candlestick is in the negative zone and it confirmed the bearish pattern. Following the bearish signal, the stock started to move lower towards $136.

Note:

The gap opening is a rare phenomenon in the Forex market that’s why the Dark

Cloud Cover pattern is more useful in the stock market.