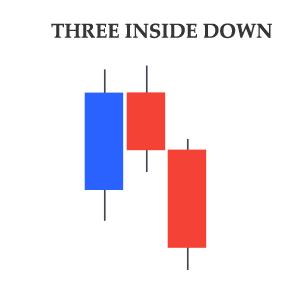

Three Inside Down

Three Inside Down is the opposite of the Three Inside Up pattern as it indicates a bearish reversal. The pattern is comprised of three candlesticks. The first candlestick in this pattern is bullish and has a long real body that shows the bulls are in control. The second candlestick in the pattern has a small real body and it remains contained within the real body of the first candlestick. The third candlestick that confirms the pattern is bearish and has a long real body and it closes significantly lower than the low of the first candlestick. A general rule of thumb is that the deeper the third candlestick closes the stronger the pattern is.

To further understand the pattern let’s take a look at the following chart of GBP/JPY. You can see the pair was moving higher until a Three Inside Down pattern appeared around 139.50. The first candlestick is bullish which is followed by a bearish candlestick. The third candlestick in the pattern is also bearish and has a long real body. The third candlestick closed way below the closing of the first candlestick and confirmed the bearish reversal. Following the reversal signal, the pair started to move lower towards 133.00

- Next Lesson