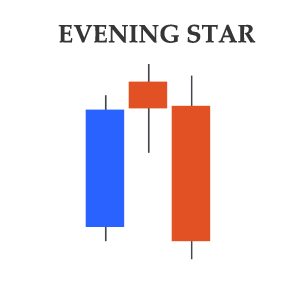

Evening Star Pattern

The Evening Star pattern is also made up of three candlesticks. This pattern is the opposite of the Morning Star because it indicates a bearish reversal. Just like Morning Star, the pattern gets its name from the middle candlestick that looks like a star in the west.

The first candlestick in this pattern is bullish and has a big real body. The first candlestick indicates that the bulls are in control until this moment. The second candlestick has a small real body that opens higher than the closing of the first candlestick. Basically, the gap opening of the second candlestick gives a warning of a possible top. The third candlestick in this pattern is bearish and has a long real body that penetrates through the body of the first bullish candlestick.

The third candlestick completes the pattern and indicates that the bulls might have lost control and the trend may reverse anytime.

Take an example of the following EUR/JPY chart to understand how an Evening Star pattern can be useful for spotting a bearish reversal. The pair was trending up when an Evening Star pattern appeared near 137.50. The first candlestick in the pattern is bullish and shows the control of bulls. The second candlestick slightly gaps higher from the first candlestick. The third candlestick is bearish and its real body completely covers the first bullish candlestick. Following the appearance of the Morning Star pattern, the uptrend reversed and the pair moved significantly lower.