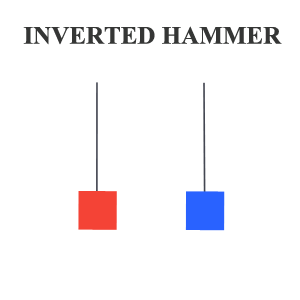

Inverted Hammer

An inverted hammer is also a bullish reversal pattern. The shape of this pattern is opposite to the Hammer. Its real body is found at the bottom and has a long upper wick. The lower wick is either very small or does not exist at all. The candlestick color has no real significance however, the size of the upper wick should be double the size of the real body.

Just like the Hammer, the inverted hammer also indicates that the bears are losing control. However, this pattern is considered a weak pattern compared to the Hammer. Therefore it is wise to seek a second confirmation from another pattern before placing a trade.

Let’s take a look at the following EUR/CAD chart to understand how an Inverted Hammer can indicate a possible reversal. The pair was falling from 1.52000 until an Inverted Hammer appeared around 1.5000. The pattern signaled a possible reversal and soon after the signal the pair started to recover and made a huge rally of over 200 pips.