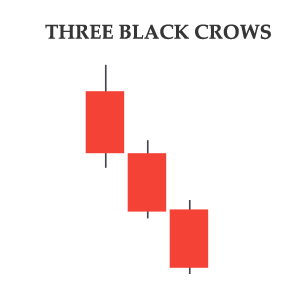

Three Black Crows Pattern

Three Black Crows is another bearish reversal pattern that is comprised of three candlesticks. The pattern perhaps gets its name from the black and white charts. In this pattern, all three candlesticks are bearish and they are formed in a way that it looks three crows are perched on a tree branch.

The opening of each candlestick remains within the body of the preceding candlesticks. The closing of each candlestick also remains near the low. Such a candlestick pattern formation indicates that each session is having a lower closing than the previous session therefore the ongoing upward trend might reverse.

The following chart of EUR/CAD is a classic example of how a Three Black Crows pattern indicates a bearish reversal. The pair was moving significantly higher until around 1.15900 the Three Black Crow pattern emerged. You can see that the second and third candlesticks have their openings within the body of the previous candlestick thus confirming the Three Black Crows pattern. Following the pattern, the pair started to move lower towards 1.15400.