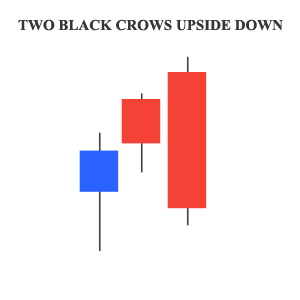

Two Black Crows Upside Down Pattern

Two Back Crows Upside Down Pattern is comprised of three candlesticks and it’s a bearish reversal pattern. The first candlestick in this pattern is bullish while the two remaining candlesticks are bearish. This distinguishing thing in this pattern is that the second candlestick opens higher than the closing of the first candlestick and its closing is also higher than the opening of the first candlestick. Finally, the third candlestick also gaps higher from the closing of the second candlestick but it closes below the second.

The second and the third candlesticks in this pattern symbolize a crow sitting up and looking down. The rationale behind this pattern is that we have a higher closing in the first session and then in the second session, the candlestick opens higher but closes at or near the low. The second candlestick is not completely bad but it is the third candlestick that changes the outlook of the market. Because despite opening higher than the previous two candlesticks it closes deep in the red zone.

Take a look at the following chart of Facebook, the share was gradually rising until a Two Crows Upside Down Pattern emerged near $154. The first candlestick in the pattern is bullish. The second candlestick opens higher than the closing of the first candlestick but it closes lower and turns out to be a bearish candlestick. The third candlestick once again opens higher than the closing of the two previous candlesticks. The third candlestick then closes below the closing of two previous candlesticks and confirmed the pattern. Following the reversal signal, the share started to drop towards $144.