Are you looking to buy Google stock but wondering whether to buy GOOG or GOOGL? Well, both stocks belong to Alphabet Inc. It’s a multinational company established in 2015 as part of Google’s corporate restructuring.

Alphabet has two classes of stocks, GOOGL (Class A shares) and GOOG (Class C shares). The primary difference between these two classes lies in voting rights. However, the GOOG vs GOOGL debate is an ever-lasting one for investors.

Let’s understand the background of Alphabet Inc. to understand the differences between the two stocks.

Background of Alphabet

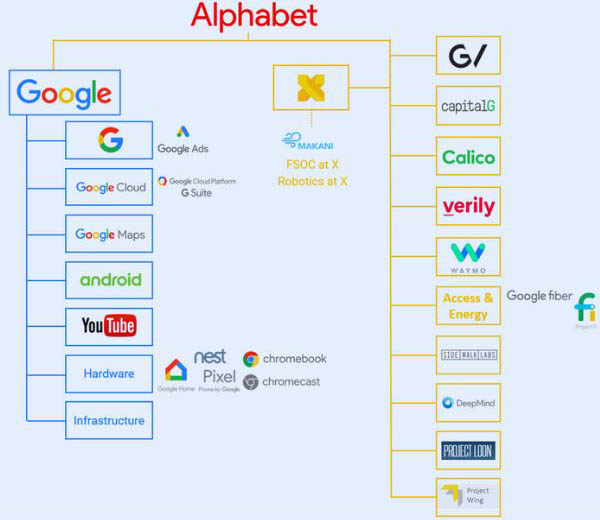

Google went through a corporate restructuring in 2015 forming a new company Alphabet Inc. This restructuring separated Google’s core internet-related businesses from its more experimental ventures.

Larry Page became the CEO of Alphabet and Sundar Pichai became the CEO of the newly streamlined Google.

As part of the restructuring, Google remains the most significant subsidiary consisting of search engine, advertising, and other internet-related services. Whereas Alphabet serves as the parent company for various subsidiaries focusing on areas such as life sciences, investment, and technology incubation.

Major Subsidiaries of Alphabet

- Google: The core subsidiary, including the search engine, advertising, and popular services like YouTube, Android, and Google Maps.

- Calico: It is focused on biotechnology and life extension.

- Verily Life Sciences: This concentrates on health and life sciences, with projects related to medical research and technology.

- Waymo: This is a self-driving technology company. It was initially started as a project within Google.

- DeepMind: DeepMind is an artificial intelligence research lab focusing on deep technology learning and AI applications.

GOOG Vs GOOGL

GOOGL and GOOG are ticker symbols that represent different classes of common stocks of Alphabet Inc., the parent company of Google. The distinction between GOOGL and GOOG lies in the voting rights of each class of shares.

- GOOGL (Alphabet Inc., Class A shares): Class A shares come with voting rights that allow shareholders to have a say in corporate decisions and board elections. They typically carry one vote per share. This allows investors to influence the company’s governance.

- GOOG (Alphabet Inc., Class C shares): These shares do not come with voting rights. Class C shares were designed to allow the company’s founders to retain control over major decisions without diluting their voting power. Class C shares receive the same economic benefits as Class A shares but cannot vote on company matters.

While voting rights represent the main distinction between GOOG vs GOOGL, there are other factors to consider as well.

- Stock Price and Market Capitalization: Class A shares (GOOGL) and Class C shares (GOOG) have different market prices even though they represent ownership in the same company. The price difference may be influenced by the voting rights associated with Class A shares. However, both classes generally have the same economic interest in the company’s performance.

- Stock Splits and Dividends: Both classes of shares participate equally in stock splits and dividends. Any stock split or dividend declared by Alphabet would typically apply equally to both Class A and Class C shares. Therefore, the economic benefits associated with ownership are generally the same.

- Convertible Nature: In the event of a merger or other corporate actions that might affect the shares, Class A shares are convertible into Class C shares on a one-to-one basis. This conversion feature helps maintain the economic interests of Class A shareholders.

Free Candlestick Patterns Course

Stock Performance – GOOG VS GOOGL

Here is a comparison of the historical stock performance of GOOG (Alphabet Inc. Class A shares) and GOOGL (Alphabet Inc. Class C shares):

- GOOG has generally traded at a higher price than GOOGL since its initial public offerings.

- Both stocks saw strong growth over the last decade, with GOOG increasing over 800% from its IPO price of $85/share in 2004 to over $100/share currently. GOOGL has increased over 700% from its IPO price of $338/share in 2014 to around $95/share currently.

Dividend History

- Neither GOOG nor GOOGL pay a dividend. Alphabet has never paid a regular or special dividend on its shares since becoming a public company.

Alphabet Stock Splits

Alphabet Inc. has undergone stock splits in the past which can affect the stock’s historical performance:

- April 2014

- Google executed a 2-for-1 stock split. Existing shareholders received an additional share for each share they owned.

- Class A and Class C shares both participated in this split.

- July 2015

- Google implemented a complex stock split. They created a new class of non-voting shares (Class C) under the ticker symbol GOOG.

- Class A shares continued to trade under the existing ticker symbol GOOGL.

- This split aimed to preserve the founders’ control by issuing non-voting shares.

Considerations

The following are some points that should be considered to make an informed decision about which Google stock to buy.

- Investor Preferences: When analyzing the GOOG vs GOOGL debate, investors must weigh their preferences on voting rights versus potential price differences between the two classes.

- Price Differences: GOOGL typically trades at a slightly higher price than GOOG due to the added voting rights. The price difference varies over time based on market conditions.

- Corporate Structure Changes: Alphabet Inc. may implement changes in its corporate structure. This will impact the stock classes. Investors should stay informed about any updates from the company.

Recent Developments and News

The ongoing GOOG vs GOOGL debate becomes more complex given Alphabet’s changing corporate structure over time. Here are some recent developments related to Alphabet Inc. that may have impacted the stock performance of GOOG and GOOGL:

- In July 2022, Alphabet reported its second-quarter earnings which beat analyst expectations on revenue but missed on earnings per share. Revenue grew 13% year-over-year to $69.7 billion but earnings per share fell to $1.21, below the $1.27 estimate. This news caused GOOG and GOOGL shares to drop over 7% the next day.

- In October 2022, Alphabet announced a 20-for-1 stock split which took effect in July 2022. Stock splits generally make shares more affordable for individual investors and can boost liquidity. This positive development likely supported GOOG and GOOGL share prices in recent months.

- In October 2023, Alphabet reported third-quarter earnings that beat expectations, with revenue growing 6% to $69.1 billion and earnings per share of $1.06, exceeding estimates. They also announced a $70 billion share buyback program. This strong earnings report was well received by investors and may have contributed to the rise in GOOG and GOOGL share prices.

Final Words

Overall, the GOOG vs GOOGL decision requires a close examination of factors like voting rights, price trends, corporate actions, and one’s investment objectives. Both provide access to Alphabet’s portfolio of businesses but differ in shareholder privileges. So, choosing between the two classes is an important consideration for investors. If you are interested in buying cryptocurrencies check our guide to buy ethereum on eToro.