ICT trading refers to a set of concepts and trading methodologies of Michael J. Huddleston. Commonly known as ICT or Inner Circle Trader, these methodologies focus on Forex trading but can also be applied to other financial markets. ICT is not a specific system or software but a collection of trading techniques and ideas. It focuses on understanding market movements and conditions to gain an upper hand. This article focuses on the core components of ICT trades, including the market structure, volume, and Michael’s holistic approach to trading.

Michael J. Huddleston Founder of ICT Trading

Michael J. Huddleston is the founder of ICT, who played a crucial role in developing ICT trading. His teachings focus on the importance of a disciplined mindset, comprehensive market analysis, and the psychological aspects of trading. His contribution to developing ICT strategies sets a foundation to understand market movements deeply.

ICT Concepts

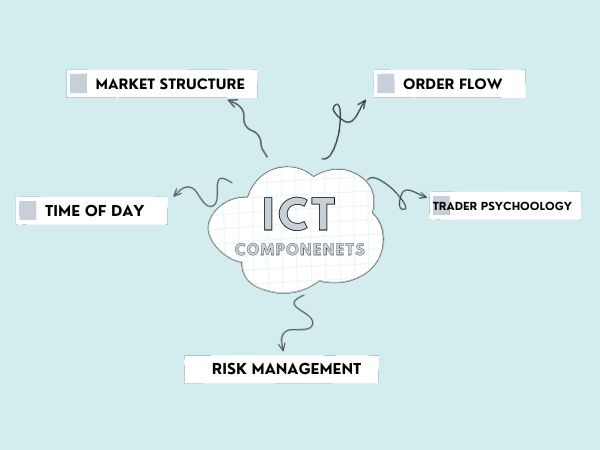

ICT trading isn’t just a set of rules or indicators but a combination of several components that represent the superficial layers of market movements. The concepts combine market psychology, structural analysis, volume, and trader behavior. Here are some of the core components of ICT trades.

- Market Structure

- Order Flow

- Time of Day/Seasonality

- Trader Psychology

- Risk Management

Now, let’s go through each ICT component.

1- Market Structure in ICT Trading

Market structure refers to the formation and characteristics of the Forex, stock, or any other financial market. It includes the number of buyers and sellers, highs and lows, support and resistance, market phases, swing points, liquidity, and trade execution. Here’s an extended look at a market structure based on ICT methodology with examples:

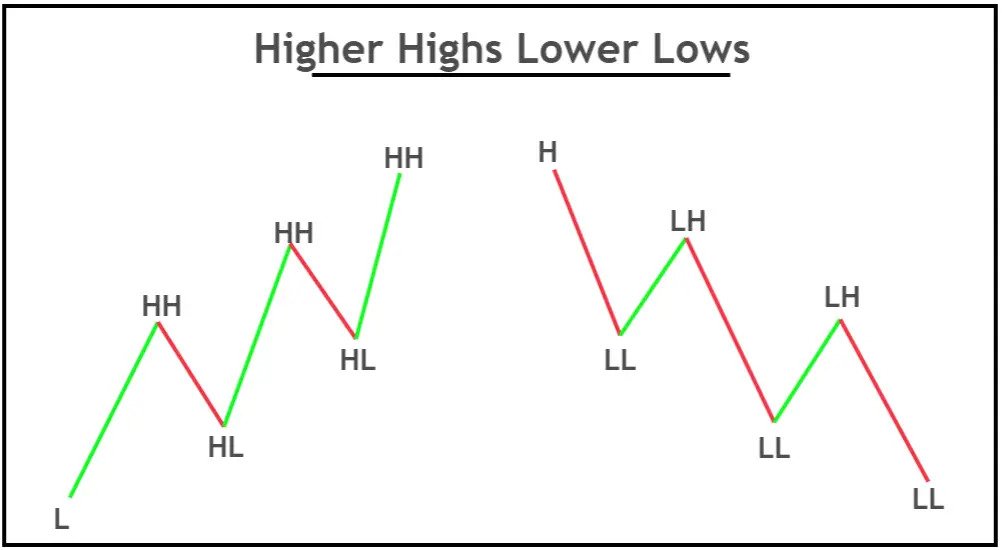

Highs and Lows

ICT trades emphasize the importance of significant market highs and lows. For example, a major high in the Forex market could be where a currency pair like EUR/USD peaked before a significant downturn. These points often act as reference points for future market activity, and traders watch these levels for signs of market reactions.

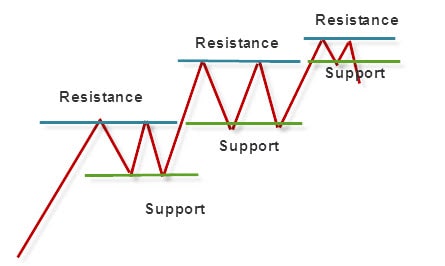

Support and Resistance

Support and resistance are not just single price points but zones where market trends can pause or reverse. For instance, if the GBP/USD pair repeatedly struggles to break above 1.4000 but bounces back each time it nears 1.3800. Then, these levels represent key support and resistance zones. ICT traders observe these levels closely for potential breakouts or reversals.

Market Phases

Markets move in phases, and each phase represents the activity of certain market players. For example, during the accumulation phase, you might notice a currency pair trading in a tight range after a significant downtrend. It can suggest that smart money is accumulating positions quietly. Recognizing this phase can alert traders to a potential upcoming uptrend.

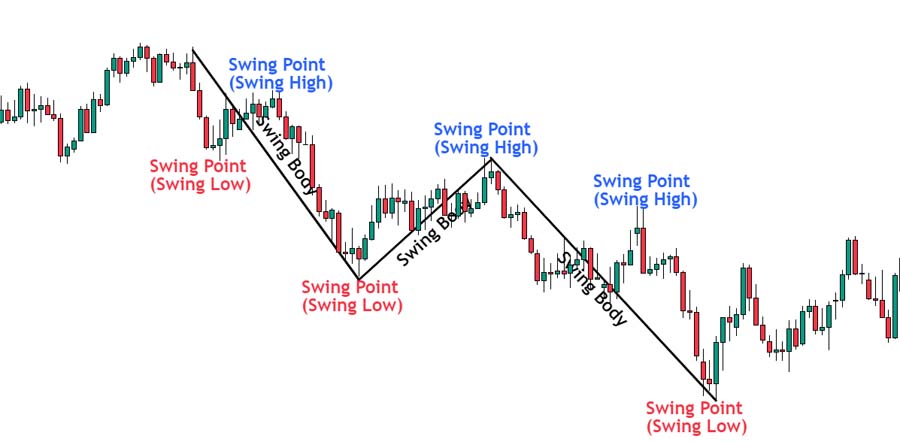

Swing Points

In ICT trades, It’s vital to identify swing points to determine market conditions. A swing low in an uptrend is followed by a new high that generally indicates the continuation of the uptrend. Conversely, if the market fails to make a new high after a swing low, it might indicate weakening momentum and a possible trend reversal.

2- Order Flow in ICT Trading

Order flow is about understanding the buying and selling activity. In ICT trades This concept is extended to gauge market sentiment and potential future price movements:

Bullish and Bearish Order Flow

Consider a scenario where a large volume of buy orders is identified at a specific support level in the stock market. This heavy stock buying interest can indicate a bullish sentiment, which suggests a potential upward move. Conversely, a surge in sell orders at a resistance level can show bearish sentiment, which hints at a possible price drop.

Order Flow at Key Levels

ICT methodology focuses on order flows at key levels to benefit from short and long-term opportunities. For instance, significant sell orders at a historically strong resistance level might signal an upcoming bearish momentum. So traders can start looking for selling opportunities.

3- Time of Day/Seasonality in ICT Trades

ICT Trades emphasize the impact of different time zones and seasons on market behavior:

Forex Market Sessions

Markets run in sessions, and each session has its characteristics. For example, the overlap between the London and New York sessions in the Forex market often has increased volatility and trading volume. This overlapping period might offer serious opportunities for trading major currency pairs.

Earnings Season in Stocks

Stock traders using ICT principles may consider the earnings season a time of increased volatility and potential trading opportunities. This is because companies’ reports can significantly affect stock prices.

4- Trader Psychology

ICT Trading places a strong emphasis on the psychological aspect of trading.

Market Sentiment

Understanding trader’s sentiments can offer clues about potential market moves. For example, extreme fear or greed in the market can signal potential reversals.

Trader Behavior

ICT considers how traders react to news or events that affect markets. For example, a sudden drop in the stock market due to negative news might lead to panic selling. ICT traders can interpret this as a potential overreaction and an opportunity to buy at lower prices.

5- Risk Management In ICT Trading

Risk management is the prime focus of ICT trading, which emphasizes paying attention to several aspects before trading.

Position Sizing

Proper position sizing is crucial in the form of trading. For instance, risking a small percentage of the total trading capital on a single trade can help preserve capital over the long term.

Stop-Loss Strategies

Using strategic stop-loss orders protects from significant losses. For example, setting a stop-loss just below a major support level in Forex trading may help limit losses if the market moves unexpectedly.

Each risk management component offers a more in-depth understanding and application of the ICT methodology.

FAQs

Michael J. Huddleston Is The Founder of Inner Circle Trader (ICT).

he core components include Market Structure, Order Flow, Time of Day/Seasonality, Trader Psychology, and Risk Management.

Market structure in ICT trading involves understanding the formation and characteristics of markets, including aspects like buyers and sellers, highs and lows, support and resistance, market phases, swing points, liquidity, and trade execution.

Risk management in ICT trading emphasizes careful consideration of various aspects before executing trades, including proper position sizing and strategic use of stop-loss orders to protect from significant losses and preserve capital over the long term.

Conclusion

The ICT trading methodology was developed by Michael J. Huddleston, who stands out for its unique approach to analyzing the financial markets. ICT components such as market structure, volume, order flow, trader psychology, and risk management equip traders with a comprehensive toolset to operate successfully in Forex, stocks, and other financial markets.