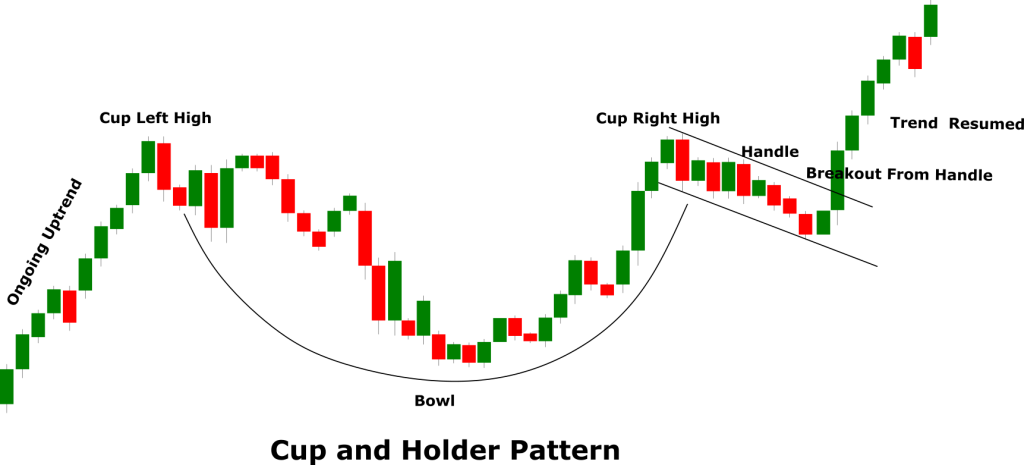

Cup and Holder Pattern

The cup and holder pattern is a bullish continuation pattern, as the name implies the pattern resembles a cup with a holder where the cup is of U shape and the handle is sort of a price channel with a slight downwards tilt. The pattern marks a consolidation period which is followed by a breakout. The breakout from the handle confirms the pattern and leads to the resumption of the prevailing uptrend. The pattern was discovered by an American technician and stock trader William O’Neil. He published the pattern in his 1988 book, How to make money in stocks.

Pattern Anatomy

The price movement of a financial asset progresses in phases. For example, a trending market is usually followed by correction or a consolidation phase. The correction indicates the imbalance between the supply and demand while a consolidation phase indicates a sort of balance However, none of the phases lasts forever and the prevailing trend either resumes or changes its direction. The cup and holder is a continuation pattern and it indicates when the market is likely to resume the ongoing trend.

The cup which is of U or a bowl-like shape first indicates the selling pressure from the investor who previously bought. The market then enters a moderate consolidation phase which forms the base of the bowl. The consolidation phase is basically a sideways period where investor wait to see if there is more selling pressure and if there is none the market moves higher which complete the U or the bowl shape. Following the higher move, another trading range develops which forms the handle, and once there is enough demand the market breaks above the trading range which completes the pattern and confirms the continuation of the trend. In a nutshell, the cup and handle pattern indicates when the demand declines or the supply increases, and traders use this pattern to establish the continuation of the trend.

The cup and holder is a bullish continuation pattern therefore it requires an established uptrend. Without the trend, the cup and the holder pattern will not be valid. Typically the trend should be in place from a few weeks to a couple of months.

The cup should have a U shape that resembles a bowl. A V kind of shape will be too sharp and may not validate the pattern. A proper U shape ensures a consolidation phase with a proper support area at the bottom.

An ideal Cup has equal highs on both sides. However, slight differences do not invalidate the pattern.

Ideally, the depth of the cup should contain 1/3 retracement of the previous higher move. In a less volatile market, a retracement of 1/2 is also valid while in any case, the maximum retracement should not exceed more than 2/3 of the previous higher move.

The duration of the Cup can extend from a few weeks to a month. The longer the duration the better the pattern shape will be.

The advance move from the right of the cup forms a new trading range which should have small pullbacks so that handle can be formed. Generally, the handle slope remains on the downside.

The handle is the final stage of the pattern and the pattern is only confirmed when the market breaks above the range of the handle.

Ideally but not always the retracement in the trading range of the handle should not extend more than 1/3 of the cup advance. The small the retracement the stronger the breakout will be.

There should be a substantial increase in the volume during the breakout from the handle. A lower volume at the time of breakout may be an indication of a divergence between the price action and the volume.

The projected target in the cup and holder pattern is generally taken by measuring the distance from the right peak of the cup to the bottom of the cup.

Using The Pattern

The cup and holder is a fairly simple pattern and like with any other pattern traders should take the necessary steps to avoid trading deceptive cup and holder patterns. Always make that the cup has a proper bowl shape. The left and the right highs of the cup should be in line while the handle should have only moderate pullbacks. It is also wise to wait for the handle breakout to be tested before making a decision. To further confirm the signal you can also wait after the handle breakout and enter when the market moves above the left and right highs of the cup.

The following GBP/USD chart is an excellent example of the Cup and Holder pattern. The pair was in an uptrend from 1.2900 until it dropped from 1.36000. Following the decline, the pair consolidated in a moderate range for some time before once again moving higher. The sideways or the consolidation period created the base of the cup while the higher move that is followed created the left high. Soon after the left high of the cup a new sideways range is formed which created the handle of the cup. The handle has small retracements and it’s sloping downwards. Soon after the handle formation, the pair broke up the handle and completed the cup and holder pattern. Following the completion of the pattern, you can see the pair resumed the ongoing uptrend and moved further higher towards 1.42000.

Trade Setup Using Cup and Holder Pattern

A continuation pattern simply tells the trader that ongoing the trend is likely to resume. So traders with existing long (buy) positions can continue holding their positions after the cup and holder pattern is formed. In addition to holding the position, you can also use the pattern to find the exit level. You can simply measure the distance between the right peak and the bottom of the cup.

For new traders, Cup and holder pattern provides the opportunity to benefit from the ongoing trend. The right entry-level is when the price breaks above the handle. For a safer entry, you can wait for the price to move above the left and right high of the cup.

The stop-loss in this trade setup simply remains below the bottom of the cup. The bottom of the cup will act as a support line from where the price has previously recovered. However, the position of the stop-loss also depends on your trading strategy and your style of trading. If you are a short-term trader, a stop-loss just below the base of the bowl will be fine. If you are a long-term trader and looking to gain maximum profit you may lower the stop-loss to the next support level. This will give you added protection in the event of sudden price movement.

The easiest way to determine the take profit while using the cup and holder pattern is by measuring the distance from the right peak to the bottom of the cup. For example, if you are trading forex and the distance between the right peak and the bottom is 60 pips then your take profit will also be 60 pips. However, this is not the only way to determine the take profit. You can also analyze the price action and if you see higher highs it would be an indication of a strong uptrend and you can place your take profit just before the next resistance area. Likewise, you can also use a momentum indicator like the Bollinger bands to determine the volatility and adjust the take profit.