Triple Bottom Reversal Pattern

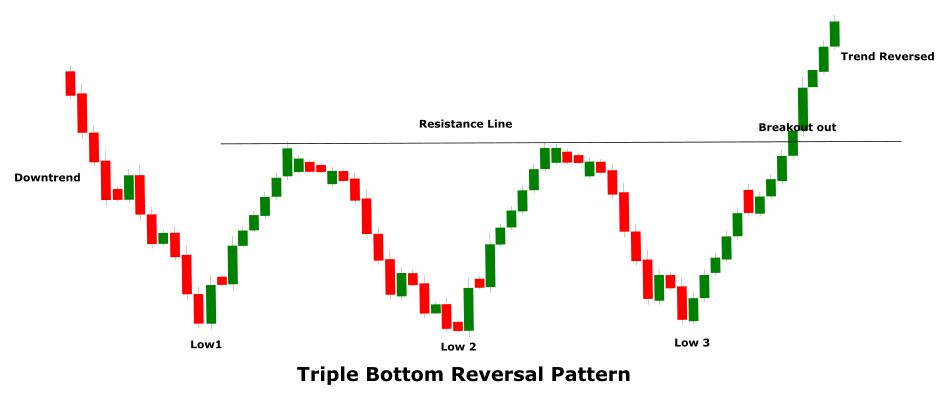

The Triple bottom Reversal is the opposite of the triple top reversal pattern as indicates a bullish reversal. The pattern appears in a downtrend and is comprised of three identical lows that are followed by a move in the opposite direction. The pattern completes and the reversal indication is confirmed when the price breaks above the resistance line created between peaks.

Pattern Anatomy

The triple bottom pattern is a bullish reversal pattern meaning it tells the traders about a possible change in the falling prices. The first rise that marks the beginning of the pattern indicates an increase in the demand likewise the next two higher moves further confirm the increasing demand which eventually causes the downtrend to reverse.

The triple bottom is a bullish reversal pattern and like any other bullish reversal pattern, it also requires a strong downtrend that should be in place from a few weeks to a couple of months.

To have a strong indication from a triple bottom pattern, the period between the three lows should be between a few weeks to a couple of months.

The first two low in this pattern indicate the two lowest points in the ongoing downtrend and do not necessarily mean that trend has changed. These lows could well be a small correction phase and the ongoing downtrend may resume.

The rise from the third low does not confirm the signal. The signal is confirmed only when the price breaks above the resistance line that is created between the three peaks. The resistance line is often breached when the volume is high.

The three lows should be almost identical. Likewise, the advance between the lows should also be consistent. However, the lows or the highs between the three lows can extend but the overall movement should remain within the range.

In an ideal situation, the second and the third low should be contained within the first low. If the third low extends below 5% of the first low there will be fewer chances of a reversal and the market may resume the ongoing downtrend.

As the triple bottom pattern forms the volume usually declines. However, the volume again increases near the lows as the market generally moves in the opposite direction from that point.

Once the resistance line between the three lows is breached it acts as a support area. For a strong confirmation, it is always a good idea to have the newly established support line tested a few times.

Using The Pattern

The triple bottom pattern is considered a stronger reversal pattern compared to the double bottom pattern. However, despite that, you should take extra measures to confirm the signal. You should make sure that lows in the pattern are not too close. If they are too close it may be a regular correction and not a sign of a trend reversal. You should also pay attention to the rise between the peaks. If the rise or the advance is way too small this may not result in a trend reversal. Likewise, volume is also an important aspect and should be observed closely. A contracting volume near the third low favors the bearish bias. Therefore a high volume near the third low should be present and closely observed.

The following example of the EUR/JPY shows the significance of a triple bottom reversal pattern in the downtrend. The pair was in a downtrend from 126.00 which continued until the first rise started near 110.00. The rise formed the first low in the pattern. After rising nearly 400 pips from the first low the bearish momentum once again picked up which is again followed by a small upwards rally. The two upwards move created a significant rea area in between the peaks and caused the price to fall for the third time. However, the pair even failed for the third time to move below the previous two lows and this time the upwards rally extended above the newly established resistance line. The breakout above the resistance line confirmed the Triple bottom reversal pattern and you can the pair gradually moved higher towards 123.00 in the coming session.

Trade Setup Using Triple Bottom Reversal Pattern

The triple bottom is considered a stronger reversal pattern compared to the double bottom reversal pattern and it presents great opportunities to benefit from a possible change in the ongoing trend. Since it is a bullish reversal pattern, it is ideal to enter a long trade after the resistance line between the peaks is breached. As a trader, you can raise the odds in your favor by entering the short trade after the support line is tested a couple of times.

A reasonable stop-loss for this trade remains below the recently breached resistance line which then acts as a support line. If you want to trade even more safely you can keep your stop-loss below the three peaks as it provides an extra cushion in the event of a sudden spike.

The take profit in this trade setup is generally kept just above the below the next resistance level. The take profit level can also be determined by using technical indicators. The RSI, MACD, and Moving average indicators can all help to determine the take profit level and maximize the profit. For example, if you use the RSI, you can continue holding the trade until the RSI reaches the overbought zone. Likewise, if you use the MACD you can close the position whenever there is a bearish crossover or when the MACD moves above the middle line.